How will a recession impact the local real estate market?

In recent months, talks of an impending recession have become more and more regular. The truth is, recessions are normal in any functioning economy.

But without the right information, recession becomes a word used to strike up fear and discomfort. And it works, it keeps us tuned in.

And let’s be honest, there are many faces in the media who are rooting for a recession believing it will keep a certain individual from getting reelected.

We all lived through the Great Recession of 2008, some even still recovering (financially or emotionally). It’s not surprising that talk of the “R-word” evokes a sense of fear – myself included.

I think it’s important we’re all in the loop. So, I looked into it and I’m here to calm some of those fears and share a few facts and forecasts by actual economists.

*I have a degree in finance and real estate, I’ve been through 2 recessions as a Realtor in my 20 year career, and I was licensed stock broker in a previous career. (Data and analysis by mykcm.com.)

Don’t Let the R-Word Scare You

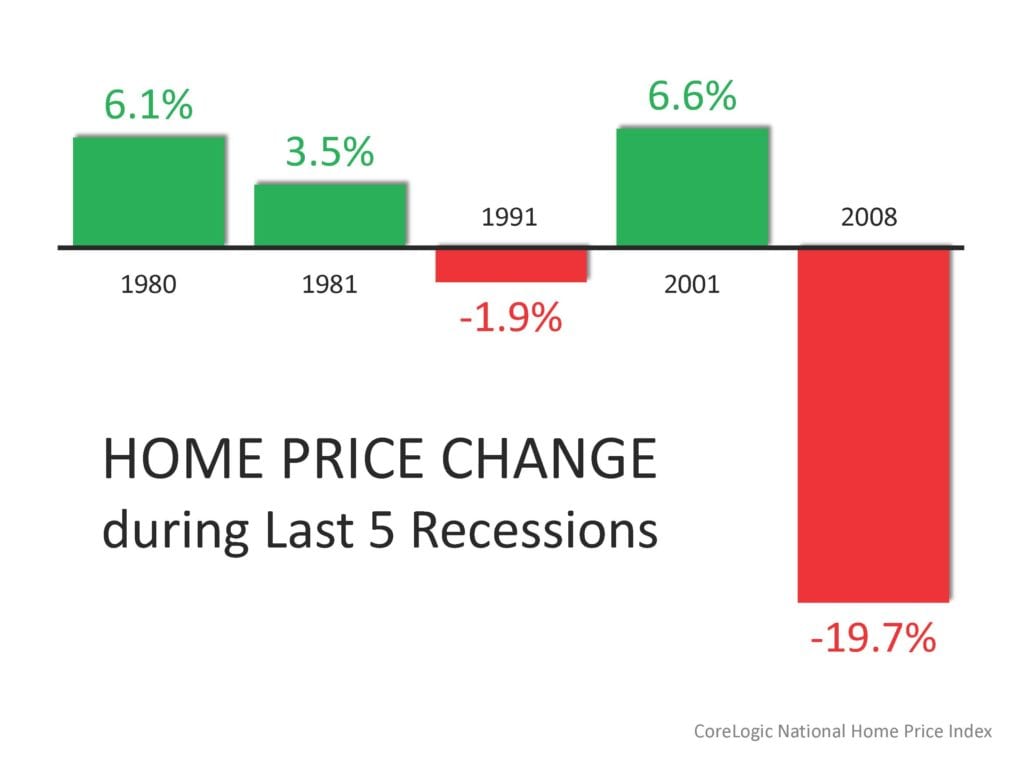

Depending on what you watch and what you read, there’s a good chance you’re going to hear lots of recession talk throughout 2022. But a recession does not always equal a market (or housing) crash. In fact, home prices often go up during a recession.

RECESSION ≠ HOUSING CRASH

Fun Fact: Home prices have gone up 3 out of the last 5 recessions.

It’s true! Before 2008, the previous recession was back in 2001 (I bet we both forgot about that one). In 2001, home prices went up 6.6%. Almost double historical norms.

In 2008, the real estate market caused the great recession. Consider that recession more of an outlier than the standard measure for comparison or projection. In fact, most economists expect the next recession to look a lot more like 2001 than 2008.

Recession Definition: Two (2) consecutive quarters of negative Gross Domestic Product (GDP) growth.

Yep! That’s all a recession is. Two consecutive quarters of negative GDP growth. Whether that’s a drop of 4% or .04%, a recession is a recession. The truth is, recessions are unavoidable. The U.S. has had 47 recessions since the Articles of Confederation and we’ve survived them all.

We’ve actually had recessions where the overall economy grew on an annual basis. But, because 2 consecutive quarters within that year were down, by definition, it was a recession.

So, what could a recession mean for the local real estate market?

In 2008, we know what triggered the great recession – overly inflated housing prices fueled by questionable lending standards (to put it lightly). Frankly, the housing market was the cause of the recession.

Fortunately for us all, that’s not likely the case next time. The most recent survey of economists and market analysts asked what will trigger the next recession:

…Coming in at #9…

What’s the difference today?

In the early 2000s to 2008, it was common to qualify for a stated income loan having zero money down and any credit score (in other words, buyers were poorly qualified). That’s not the case today. Stricter lending standards require homeowners to put more money down and be fully qualified, greatly reducing the chance of another housing collapse.

In 2001, the dot com bubble was the cause of the recession. In fact that’s partially why home prices went up. Money left the stock market and moved to the real estate market. Many economists are forecasting that to happen again during the next recession – investors will move their money from the volatile stock market to the housing market causing prices to go up.

What do pros have to say,

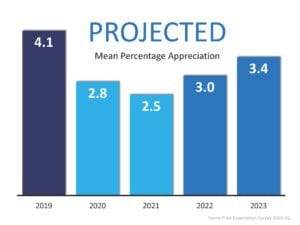

Recently in a survey, 96 economists and real estate market analysts predicted a recession may occur in the next 18 months. On that same day, the same experts in the same survey were asked how home prices would react. Below is their answer. As you’ll see, appreciation may slow but no call for home values to depreciate.

What should you do?

Keep all variables in perspective as you continue your home search. Remember, it’s a long term investment. It’s easy to get hung up on the price of a home. But a home is actually more than an investment. It’s where lives are created and memories are made.

Don’t get me wrong, price is important. But there’s always more to the equation, for example:

- If interest rates started to go up and prices came down a bit, you could end up with a higher payment than you’d have today with the low rates that are available.

- If you plan on being in the home for over 5-10 years, history is on your side that the home will appreciate.

The truth is, there are 101 ways to talk yourself out of buying your next home.

But it doesn’t mean you should. Stay informed, ask the right questions, ask yourself if you’re financially and emotionally ready. And trust the natural flow of a healthy economy.

There will undoubtedly be a recession in the future, but that does not mean we are staring down the barrel of the next coming of ‘08.

So, where do you go from here?

That depends on where you are in your home search… but you have options:

We love to stay up to date with the local market, join us with Michael’s Monthly Market Update.

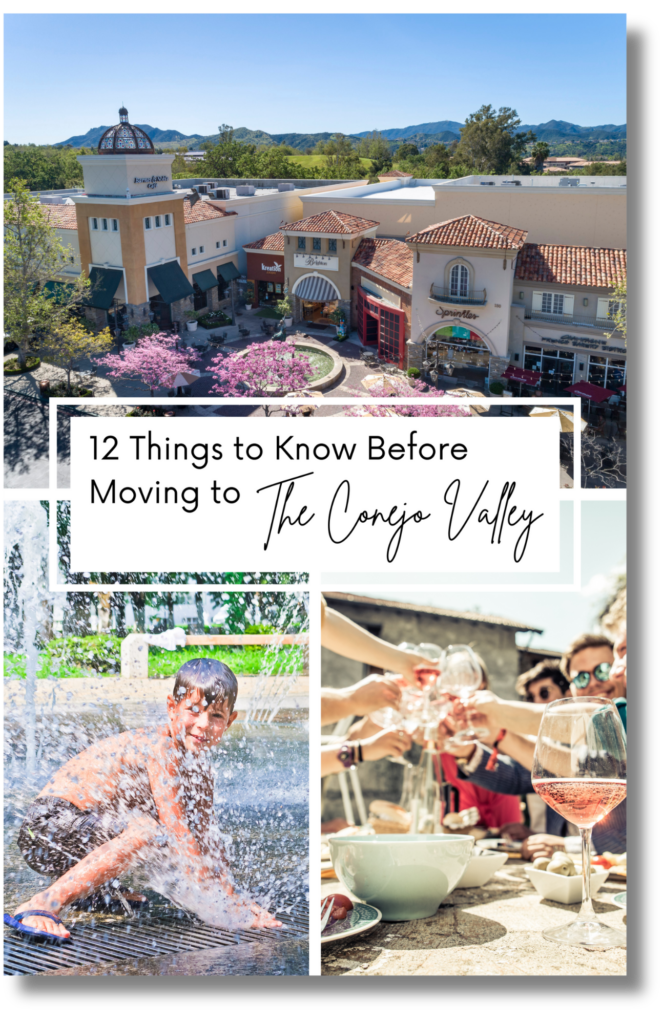

Ready to buy? That’s our specialty. We’re a couple of Conejo Valley gurus and neighborhood experts – let’s find you a home you’ll love.

No matter what you’re looking for, we’ll help you find it!